Gearing up for an Accounting Manager interview?

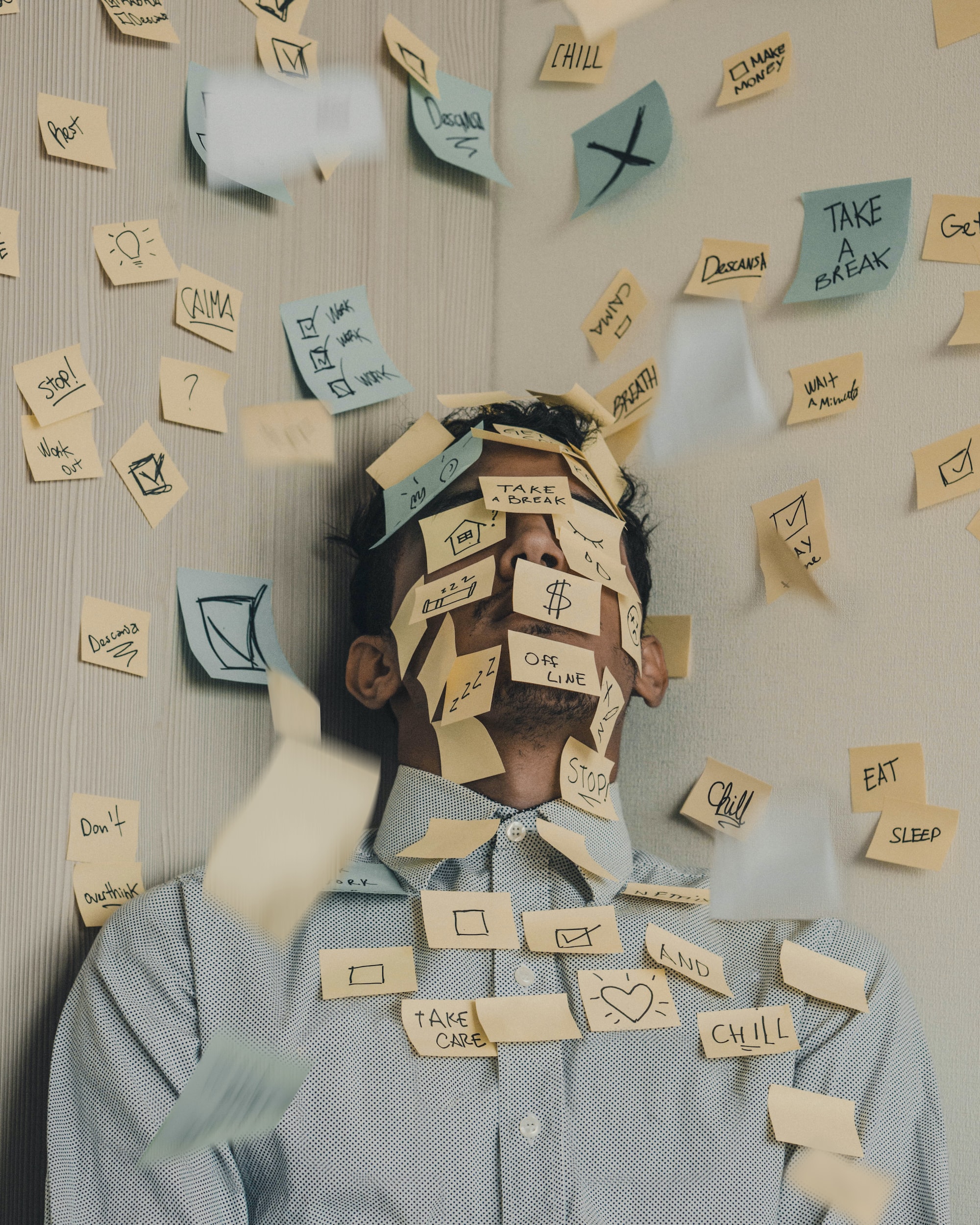

Interviews are crucial and can be nerve-wracking, especially in a competitive field like accounting.

If you are unsure where to start and what questions to prepare, this article is for you!

Read on to learn more about the role, followed by 30+ crucial accounting manager interview questions and tips to help you stand out.

What Does an Accounting Manager Do?

An Accounting Manager is a senior-level professional who supervises the accounting team, manages financial operations, and contributes to the organization's financial management.

They are responsible for maintaining the integrity of financial data, preparing financial reports, and supporting strategic decision-making.

Key Responsibilities include:

Financial Reporting: Oversee the preparation of accurate and timely financial statements, including balance sheets, income statements, and cash flow statements, ensuring compliance with accounting principles and regulatory requirements.

Budgeting and Forecasting: Collaborate with various departments to develop budgets, monitor performance against budgeted targets, and provide financial forecasts to support strategic planning and resource allocation.

Internal Controls and Compliance: Establish and maintain internal control procedures to safeguard assets, prevent fraud, and ensure compliance with financial regulations, industry standards, and company policies.

Staff Supervision and Management: Provide guidance, training, and supervision to the accounting team, assign tasks, monitor progress, and ensure the timely completion of financial tasks such as accounts payable, accounts receivable, and payroll.

Financial Analysis: Conduct financial analysis, interpret data, and provide insights into the company's financial performance. Identify trends, variances, and improvement opportunities to present findings to management for informed decision-making.

Audit and Taxation Support: Coordinate and liaise with auditors during financial audits, providing necessary documentation and addressing any audit findings. Collaborate with tax professionals to ensure accurate and timely tax compliance, including tax filings and calculations.

System Implementation and Improvement: Assess existing accounting systems and processes, identify areas for improvement, and participate in system implementation or upgrade projects. Streamline processes, automate tasks, and leverage technology to enhance efficiency and accuracy in financial operations.

Accounting Manager Interview Questions

Here are 30+ most commonly asked accounting manager interview questions:

1. Can you tell us about your previous experience as an Accounting Manager?

In my previous role as an Accounting Manager at XYZ Company, I was responsible for overseeing all aspects of the accounting department.

I managed a team of accountants, handled financial reporting, budgeting, and forecasting, ensured compliance with accounting regulations, and collaborated with other departments to achieve financial goals.

I implemented process improvements that streamlined operations and improved efficiency. Overall, my experience as an Accounting Manager has given me a strong foundation in managing financial functions and leading a team.

2. How do you handle budgeting and forecasting as an Accounting Manager?

When it comes to budgeting and forecasting, I take a comprehensive approach.

I start by analyzing historical financial data, market trends, and operational plans to establish a baseline.

Then, I work closely with department heads and key stakeholders to gather input and align financial goals with the business strategy.

I pay attention to details and ensure that the budget is realistic and achievable.

Throughout the year, I closely monitor actual performance against the budget and make necessary adjustments to meet financial targets.

3. What accounting software or tools are you familiar with?

I am proficient in various accounting software and tools, including but not limited to QuickBooks, SAP, Oracle Financials, and Microsoft Excel.

I have extensive experience using these tools for financial data management, reporting, analysis, and reconciliation.

I am also adaptable and quick to learn new accounting software, so I can easily adapt to the systems used by your organization.

4. What are the five crucial accounting tools that you swear by?

The five tools I swear by are:

Accounting Software: Accounting software such as QuickBooks, Sage, or Xero are essential tools for efficient financial management.

I have hands-on experience with these tools, which streamline processes like bookkeeping, invoicing, and financial reporting.

Spreadsheet Software (Excel): Excel is an indispensable tool for accountants. I am proficient in utilizing Excel for tasks such as data analysis, creating financial models, budgeting, and generating reports.

Its advanced functions and formulas enhance accuracy and facilitate complex calculations.

Electronic Document Management Systems: Document management systems like SharePoint or Google Drive help maintain an organized digital filing system.

These tools ensure easy access to financial records, invoices, receipts, and other important documents, improving efficiency and reducing paperwork.

Data Analysis and Visualization Tools: Tools like Tableau, Power BI, or Excel's data analysis features enable me to analyze large datasets, identify patterns, and present data in visually compelling ways.

These tools help in making data-driven decisions and communicating financial insights effectively.

Tax Preparation Software: Tax preparation software such as TurboTax or professional tax software simplifies the process of preparing tax returns.

These tools stay updated with the latest tax laws, guide accurate data entry, and help optimize deductions, ensuring compliance while minimizing tax liabilities.

These accounting tools have been integral to my professional experience, enhancing productivity, and accuracy, and providing valuable insights. Utilizing these tools, I can efficiently manage financial data, streamline processes, and support informed decision-making within an organization.

5. Can you describe your approach to managing a team of accountants?

As an Accounting Manager, I believe in fostering a collaborative and supportive work environment for my team.

I provide clear expectations and objectives, delegate tasks based on individual strengths, and encourage professional development.

I promote open communication and actively listen to my team members' ideas and concerns. I believe in recognizing and appreciating their efforts and providing constructive feedback to help them grow.

By empowering and motivating my team, we can achieve exceptional results together.

6. How do you prioritize your tasks and manage multiple deadlines?

Managing multiple deadlines requires strong organizational and time management skills. I begin by assessing the urgency and importance of each task.

I then prioritize them based on their impact on financial goals, dependencies, and critical timelines.

To stay organized, I utilize task management tools and create detailed schedules with realistic timelines. Regular communication and collaboration with team members and stakeholders also help ensure that everyone is aligned and aware of deadlines.

Additionally, I try to proactively identify potential bottlenecks and take necessary steps to mitigate risks and meet deadlines.

7. Tell us about a challenging accounting problem you faced and how you resolved it?

In a previous role, our company experienced a significant discrepancy in accounts payable and receivable records due to a system glitch.

It was a challenging situation that required quick action and attention to detail. I immediately assembled a cross-functional team consisting of IT, finance, and operations personnel to investigate the issue.

We thoroughly reviewed the affected transactions, identified the root cause, and implemented a temporary workaround to ensure accurate financial reporting.

Simultaneously, we collaborated with the IT team to fix the system issue and conducted a comprehensive accounts reconciliation.

By effectively coordinating team efforts and maintaining open communication, we successfully resolved the problem within a short timeframe, ensuring minimal impact on financial operations.

8. How do you analyze financial statements and use the information to make strategic decisions?

When analyzing financial statements, I start by reviewing the income statement, balance sheet, and cash flow statement to gain a holistic understanding of the company's financial performance.

I analyze key financial ratios, trends, and benchmarks to identify areas of strength and areas that need improvement. I compare the company's financial performance to industry standards and competitors to gain insights into the overall market position.

This analysis helps me make informed strategic decisions, such as resource allocation, cost reduction initiatives, and investment opportunities.

I also collaborate with other departments to gather additional context and ensure that financial decisions align with the overall business objectives.

9. How do you collaborate with other departments, such as sales or operations, to achieve financial goals?

Collaboration with other departments is essential for achieving financial goals. I believe in establishing strong working relationships and open lines of communication with stakeholders from various departments.

I actively participate in cross-functional meetings to gain insights into their challenges, objectives, and initiatives. By understanding their needs and providing financial guidance and support, I can contribute to developing realistic financial plans that align with their goals.

I also provide regular updates on financial performance, seek feedback, and identify opportunities for process improvement or cost-saving measures that benefit the entire organization.

10. Can you give an example of a cost-saving initiative you implemented in your previous role?

In my previous role, I identified an opportunity to optimize the procurement process and reduce costs.

By conducting a thorough analysis of our vendor relationships and negotiating better terms, we achieved significant cost savings.

Additionally, I implemented a centralized purchasing system that streamlined the procurement process and improved efficiency.

This initiative resulted in a reduction in overall procurement costs by 15% within the first year.

Note: Quantifying the results always has a better impact on the recruiters as it allows them to understand the magnitude of your action and success rate.

11. How do you handle financial audits and ensure accurate and timely reporting?

Financial audits are critical for ensuring accuracy and compliance. To handle audits, I ensure that all financial records and supporting documents are well-organized and readily accessible.

I collaborate closely with auditors, providing them with the necessary information and addressing any inquiries promptly.

Throughout the audit process, I maintain open communication with the auditing team, ensuring transparency and addressing any potential issues or discrepancies.

By following robust internal controls and conducting regular self-audits, I strive to ensure accurate and timely reporting.

12. Describe your experience with cash flow management and working capital optimization.

Cash flow management and working capital optimization are essential for maintaining the financial health of an organization.

In my previous role, I actively managed cash flow by analyzing cash inflows and outflows, forecasting short-term and long-term cash needs, and implementing strategies to improve cash flow.

This involved optimizing accounts payable and receivable processes, negotiating favorable payment terms, and effectively managing inventory levels.

By implementing these measures, I was able to improve cash flow, reduce the company's reliance on external financing, and enhance overall working capital efficiency.

13. How do you handle accounts receivable and collections?

Managing accounts receivable and collections requires a proactive approach.

I ensure that clear payment terms and conditions are established with customers upfront. I closely monitor outstanding invoices, promptly follow up on overdue payments, and maintain regular communication with customers to address any concerns or disputes.

I utilize effective collection strategies, such as sending reminders, implementing payment plans, and, if necessary, engaging in negotiations or pursuing legal action as a last resort.

By implementing a disciplined approach to accounts receivable and collections, I strive to minimize bad debts and improve cash flow.

14. What strategies do you use to minimize financial risks for the company?

Minimizing financial risks requires a comprehensive risk management approach.

I start by conducting risk assessments to identify potential financial risks, such as market volatility, credit risks, or regulatory changes.

I then develop and implement risk mitigation strategies, such as diversifying investments, hedging against currency fluctuations, establishing robust internal controls, and maintaining appropriate insurance coverage.

I also actively monitor key risk indicators, conduct regular risk assessments, and adjust strategies as needed.

By taking a proactive stance toward risk management, I aim to protect the company's financial stability and mitigate potential losses.

15. How do you stay updated on changes in accounting regulations and standards?

Staying updated on accounting regulations and standards is crucial in maintaining compliance.

I subscribe to industry publications, attend professional development seminars, and actively participate in relevant forums and networking groups.

I also engage in continuous education through professional certifications and training programs.

Additionally, I maintain close relationships with accounting professionals and utilize online resources, such as regulatory websites and accounting software updates, to stay informed about any changes or updates in accounting regulations and standards.

16. Can you explain the difference between financial accounting and managerial accounting?

Financial accounting and managerial accounting serve different purposes.

Financial accounting focuses on recording and reporting a company's financial transactions and preparing financial statements for external stakeholders, such as investors, creditors, and regulatory bodies.

It adheres to specific accounting principles and standards, ensuring accuracy, consistency, and transparency in financial reporting.

Managerial accounting, on the other hand, provides internal stakeholders, such as management and decision-makers, with relevant financial information for planning, controlling, and decision-making purposes.

It includes activities like budgeting, cost analysis, performance measurement, and forecasting, which assist in strategic decision-making within the organization.

17. How do you monitor and control expenses within a budget?

Monitoring and controlling expenses within a budget involves several steps.

First, I establish a detailed budget with input from relevant stakeholders and ensure that it aligns with the company's financial goals.

Then, I regularly monitor actual expenses against the budget, comparing variances and identifying areas of concern.

If necessary, I implement cost control measures, such as expense reduction initiatives or process improvements, while ensuring that essential operations are not compromised.

Additionally, I maintain open communication with department heads to understand their spending needs and collaborate on finding cost-saving opportunities.

Regular reporting and analysis help me track expenses and take corrective action when needed.

18. Describe your experience with financial analysis and forecasting.

Financial analysis and forecasting are key components of my role as an Accounting Manager.

I have extensive experience in conducting financial ratio analysis, trend analysis, and benchmarking to evaluate the company's financial performance and identify areas for improvement.

I use various forecasting techniques, including historical data analysis, market research, and industry trends, to develop accurate financial projections.

These projections assist in budgeting, resource allocation, and decision-making processes.

I also leverage financial models and advanced spreadsheet tools to facilitate forecasting and scenario analysis, allowing for more informed and strategic financial planning.

19. Can you give an example of a time when you improved a company's financial processes or systems?

In my previous role, I implemented an automated expense reporting system that significantly improved the efficiency and accuracy of expense management.

Previously, employees had to manually submit paper-based expense reports, leading to delays and potential errors.

By introducing the automated system, employees could submit expenses electronically, streamlining the approval process and reducing processing time.

The system integrated with the accounting software, allowing for seamless data transfer and eliminating manual data entry.

This initiative resulted in a 40% reduction in processing time and improved overall expense tracking and control.

20. How do you handle disputes or discrepancies with clients or vendors?

When faced with disputes or discrepancies with clients or vendors, I adopt a diplomatic and solution-oriented approach.

I start by thoroughly reviewing the relevant documentation and contract terms to ensure clarity on both sides.

I then initiate open and respectful communication with the involved parties to understand their perspectives and concerns. I actively listen, ask clarifying questions, and seek a mutually beneficial resolution.

If necessary, I engage in negotiation and compromise, always keeping the long-term business relationship in mind.

Maintaining professionalism and transparency throughout the process helps in resolving disputes amicably and preserving positive business relationships.

21. How do you motivate your team to achieve financial targets?

Motivating a team to achieve financial targets requires effective leadership and communication. I believe in setting clear and challenging goals that align with the team's strengths and the organization's objectives.

I ensure that team members understand the importance of their roles in achieving these goals and provide regular feedback and recognition for their contributions.

I foster an environment of trust, collaboration, and professional development, encouraging team members to take ownership of their work and providing growth opportunities.

By leading by example, celebrating successes, and addressing challenges as a team, I motivate individuals to strive for excellence and achieve financial targets.

22. Can you explain the concept of accrual accounting and its importance in financial reporting?

Accrual accounting is an accounting method that recognizes revenue when earned and expenses when incurred, regardless of cash flow.

It follows the matching principle, which aims to align revenue and expenses in the period in which they contribute to the company's financial performance.

Accrual accounting provides a more accurate and comprehensive view of a company's financial position and performance, as it reflects economic activities regardless of the timing of cash transactions.

It ensures that financial statements present a true and fair representation of the company's financial health, aiding stakeholders in making informed decisions.

Accrual accounting is crucial for compliance with accounting standards, such as GAAP and IFRS.

23. Describe your experience with tax planning and compliance.

As an Accounting Manager, tax planning and compliance are key responsibilities. I collaborate with tax experts and stay updated on tax laws and regulations to ensure compliance.

I analyze financial data and assess potential tax implications to develop tax-efficient strategies and maximize tax savings for the company.

I also oversee the preparation and filing of tax returns, ensuring accuracy and timeliness.

By conducting regular tax audits and implementing internal controls, I mitigate tax risks and maintain compliance with tax laws, minimizing the company's exposure to penalties or audits.

24. How do you handle confidential financial information and maintain data security?

Handling confidential financial information requires the utmost care and attention to data security. I strictly adhere to established security protocols and maintain robust data encryption measures.

Access to sensitive financial data is limited to authorized personnel, and I enforce strict user access controls and password protection policies.

I regularly conduct internal audits to identify and address any vulnerabilities in the data management and security systems.

Additionally, I stay updated on industry best practices for data protection and collaborate with IT professionals to ensure the implementation of security technologies and practices.

25. Can you discuss your experience with financial system implementations or upgrades?

I have successfully led financial system implementations and upgrades in my previous role.

This involved assessing the company's needs, identifying suitable systems, and collaborating with IT teams and external vendors to ensure smooth implementation.

I developed detailed project plans, coordinated user training, and conducted extensive testing to ensure the system's functionality and data integrity.

I also facilitated the migration of financial data from legacy systems and provided ongoing support to users during the transition period.

By closely managing the implementation process and addressing any challenges proactively, I ensured minimal disruption to financial operations.

26. How do you foster a culture of financial responsibility within an organization?

Fostering a culture of financial responsibility involves a multi-faceted approach. I start by promoting transparency and open communication about financial goals and performance.

I provide training and resources to employees to enhance their financial literacy and understanding of how their roles contribute to the company's financial success.

I encourage employees to take ownership of their financial responsibilities and empower them to make informed decisions within their areas of influence.

By recognizing and rewarding financial prudence, setting clear expectations, and leading by example, I instill a sense of accountability and responsibility toward financial management throughout the organization.

27. Can you discuss your experience in cost analysis and cost control?

Cost analysis and cost control are areas of expertise in my role as an Accounting Manager. I have experience conducting detailed cost analysis, examining cost drivers, and identifying opportunities for cost savings or efficiency improvements.

This involves analyzing costs across various departments, products, or services, and comparing them against benchmarks or industry standards.

I collaborate with department heads to understand cost structures, explore alternative sourcing options, negotiate better pricing terms, and implement cost control measures, such as lean processes or cost-effective technologies.

By consistently monitoring costs and implementing effective cost management strategies, I contribute to the organization's financial stability and profitability.

28. How do you ensure accurate and timely financial reporting during the month-end and year-end closing processes?

Accurate and timely financial reporting during month-end and year-end close processes is crucial for decision-making and compliance.

I ensure proper coordination and communication with the accounting team and relevant stakeholders.

We follow a detailed checklist and established timelines to ensure that all financial transactions are properly recorded, reconciled, and accurately reflected in the financial statements.

Regular progress meetings and checkpoints help us address any potential issues or discrepancies promptly.

I also perform rigorous reviews and quality checks to ensure accuracy and completeness before finalizing and distributing the financial reports to the necessary parties.

29. Can you discuss your experience with financial risk assessment and mitigation?

Financial risk assessment and mitigation are integral parts of my role as an Accounting Manager.

I have experience conducting comprehensive risk assessments to identify potential financial risks, such as liquidity risks, credit risks, or market risks.

This involves analyzing financial data, market trends, and economic indicators to assess the likelihood and impact of various risks.

Based on these assessments, I develop and implement risk mitigation strategies, such as diversification of investments, hedging, or insurance coverage.

I also establish internal controls and monitor key risk indicators to detect and address emerging risks promptly, ensuring the company's financial stability and resilience.

30. Can you provide examples of your experience and proficiency in any five accounting technical skills?

1. Financial Statement Analysis: In my previous role, I conducted in-depth financial statement analysis to assess the performance and financial health of the company. I analyzed key financial ratios, identified trends, and provided recommendations to improve profitability and efficiency.

2. Taxation: I have experience in preparing tax returns for individuals and businesses, ensuring compliance with tax laws and regulations. I have worked with clients to identify potential deductions and credits, minimizing their tax liabilities while remaining within legal boundaries.

3. Auditing: As part of an auditing team, I performed detailed audits of financial records to verify their accuracy and compliance with accounting standards. I conducted thorough assessments of internal controls, identified risks, and provided recommendations for process improvements.

4. Financial Reporting: I have prepared comprehensive financial reports, including balance sheets, income statements, and cash flow statements. I ensured accurate recording of financial transactions, adherence to accounting principles, and clear presentation of financial information.

5. Budgeting and Forecasting: I actively participated in the budgeting process, collaborating with department heads to develop accurate and realistic budgets. I monitored actual performance against budgets, identified variances, and provided insights on areas for cost-saving measures and revenue growth.

These examples demonstrate my proficiency in key accounting technical skills and my ability to contribute to accurate financial analysis, compliance, and informed decision-making within an organization.

31. How do you ensure compliance with accounting regulations and standards?

Compliance with accounting regulations and standards is crucial in maintaining the integrity and credibility of financial reporting.

To ensure compliance, I stay updated on the latest accounting standards, such as Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS).

I implement internal controls and processes to adhere to these standards and conduct regular audits to identify areas of non-compliance.

Additionally, I promote a culture of ethics and accountability within the accounting team to maintain compliance at all times.

Tips to Answer Accounting Manager Interview Questions

Here are ten unique and actionable tips for jobseekers preparing for an accounting manager interview:

1. Research the Company

Gain a thorough understanding of the company's industry, financial standing, and any recent developments. This knowledge will help you tailor your responses and showcase your alignment with the organization's goals.

2. Highlight Leadership Experience

Emphasize your experience in leading and managing accounting teams, including examples of how you motivated and guided your team to achieve goals and improve efficiency.

3. Demonstrate Financial Analysis Skills

Prepare specific examples that highlight your ability to analyze financial data, identify trends, and provide actionable insights to support decision-making.

4. Showcase Compliance Knowledge

Showcase your knowledge of accounting principles, industry regulations, and compliance standards. Discuss your experience in implementing internal controls and ensuring adherence to financial regulations.

5. Discuss System Implementation Experience

Highlight any experience you have in implementing or upgrading accounting systems, showcasing your ability to streamline processes, improve efficiency, and enhance accuracy.

6. Highlight Communication and Relationship-building Skills

Accounting managers need strong communication skills to collaborate with various stakeholders. Provide examples of how you have effectively communicated financial information, built relationships with colleagues, and supported cross-functional teams.

7. Discuss Problem-solving Abilities

Describe situations where you identified and resolved complex accounting issues, implemented innovative solutions, or improve existing processes to overcome challenges.

8. Showcase Teamwork and Collaboration

Accounting managers often work closely with other departments. Demonstrate your ability to collaborate effectively with non-financial colleagues, showing how you have contributed to overall organizational success.

9. Prepare for Behavioral Questions

Anticipate common behavioral questions and prepare thoughtful responses. Use the STAR (Situation, Task, Action, Result) method to structure your answers and provide specific examples of your achievements.

10. Ask Thoughtful Questions

Prepare a list of insightful questions about the company, the accounting department, and the specific responsibilities of the role. This demonstrates your genuine interest and engagement in the position.

Remember to practice your responses, maintain a confident and professional demeanor, and showcase your passion for accounting management during the interview.

Conclusion

An Accounting Manager plays a critical role in financial management and decision-making within an organization.

Employers seek candidates who possess a strong understanding of financial principles, analytical skills, and the ability to navigate complex financial scenarios.

As you prepare to ace accounting manager interview questions, make sure to thoroughly study and internalize the answers to these questions to gain valuable insights into the key areas that interviewers focus on.

Take the time to reflect on your experiences and accomplishments, tailor your answers to highlight unique strengths and achievements, and answer with confidence.

All the best!